CPEC : Transport & Logistics Sector Growth Potential in Pakistan. Afaq Ahmed Khan

CPEC : Transport & Logistics Sector Growth Potential in Pakistan.

Afaq Ahmed Khan (CEO Mega Movers Pakistan)

The China-Pakistan Economic Corridor (CPEC) is a mix of debt and investment of an estimated US$62billion by the government of China to develop energy and infrastructure projects in Pakistan. It is targeting 17.7% of its total CPEC investment, i.e. US$11B to the development of transport & logistics services in Pakistan [1]. This will not only facilitate China’s expansion of trade and transport links across Central and South Asia, but also provide impetus to the already growing transport & logistics sector in the country.

The growth dynamics of the sector are such that it has surpassed, the annual growth rate of GDP during 1991 and 2016 [2]. It contributed 13.3% to the GDP in 2016-2017, and this share is expected to rise by 2.5 percentage points, as CPEC projects are completed [3]. The sector is currently responsible for the creation of approximately 3 million formal jobs, which would increase to about 3.6 million with CPEC [4].

Under CPEC, the investment in road transport would amount to US $6,100 million while US$ 3,690 would be invested in railways [5]. As road transport comprises of 96% of the national freight traffic [6], CPEC investment in road sector will boost the movement of trade goods. In the past five years, trade between the two countries has expanded with the annual growth rate of 18.8% [7], which is expected to further rise with CPEC’s progression.

In line with the high investment priority to the road network, CPEC plans to transform road infrastructure from low-type [8] roads to high-type roads [9] to increase the road density and freight capacity of the corridor [10]. The national road network constitutes of 260,000 km, out of which 68.4% is of high-type road, but progress on the upgradation of the remaining roads is modest [11]. The low-typed road spread consists of 0.33 km of road length per sq. km of land area [12]. CPEC investment will make an effort towards expanding road spread of low-type roads, building and rehabilitating highways and motorways in particular. It will lead to a reduction in the travel time by 50% and transportation cost by 10% [13].

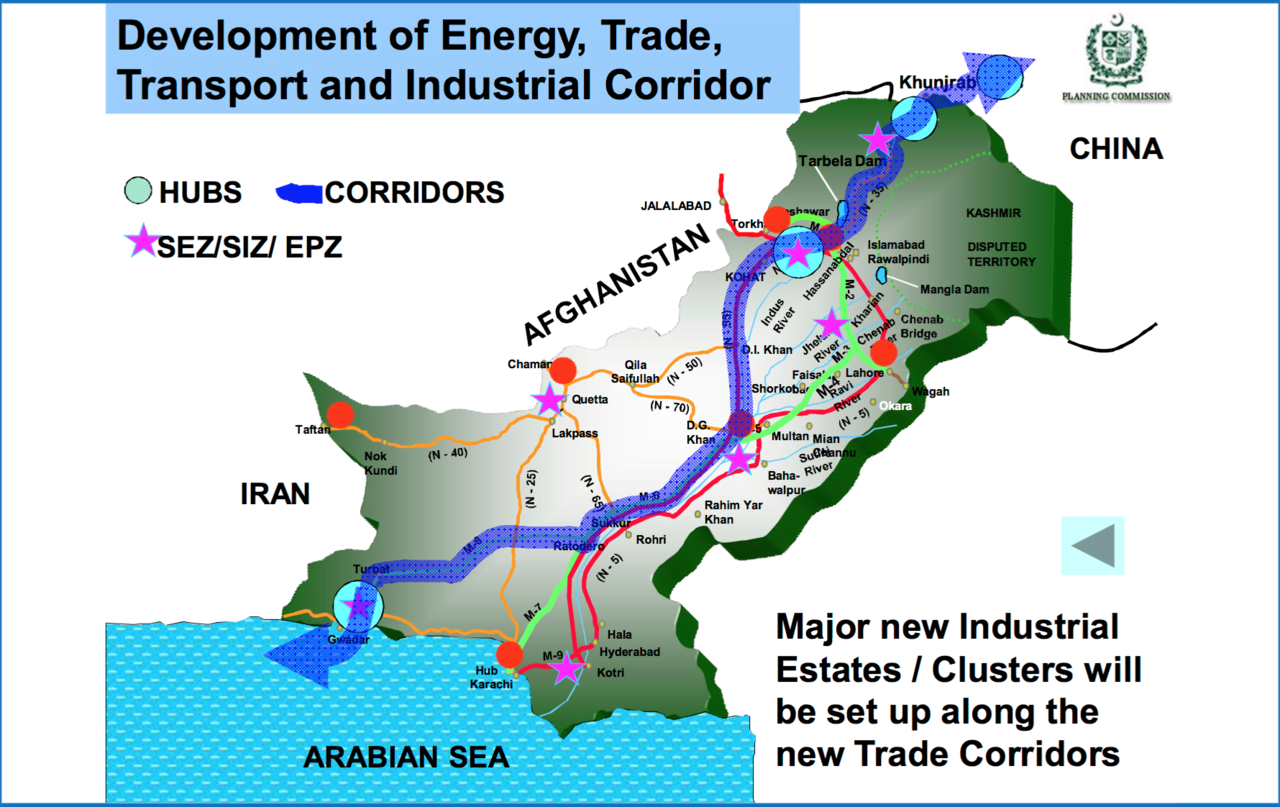

The map below shows that the transportation network constituting of ports, rails, roads, and airways is strategically integrated with Special Economic Zone (SEZs) and Industrial Parks of CPEC around the major nodal cities: Gilgit, Peshawar, Dera Ismail Khan, Islamabad, Lahore, Multan, Quetta, Sukkur, Hyderabad, Karachi and Gwadar. The integration of high profile industrial zones with the improved road network will reduce the transportation cost and result in higher inter-provincial speed connectivity [14]. Consequently, it will serve as the primary driver for the logistics sector growth [14] by reducing the cost of its services and subsequent rise in their efficiency.

The networking of industrial zones with road infrastructure correlates with the growth in freight transport and improvement in freight mobility. It may alter the vehicle ownership model given the availability of capital with owners. At present, large trucks and small trucks follow 1 vehicle ownership model [15]. Whereas, other large pickups and small pickups follow 1 and 2 ownership model, respectively [16]. 80% of owners do not intend to expand their fleet size due to lack of capital [17]. Considering the increase in demand of goods transportation, if the provision or availability of capital is ensured, an increase in vehicle-ownership ratio will be witnessed.

Pakistan may also experience a surge of private and foreign investment as the country lacks public investment in the transport sector. Only 25-30% of Public Sector Development Programme (PSDP) fund is spent on annual transport budget, which is not sufficient [18].

However, despite the growth potential, the transport and logistics sector may suffer through an intrinsic growth dilemma. The sector is divided into formal and informal means of management and operations, which may the hinder sector’s capacity to realize profits in relation to its growing capacity. There is a distinct possibility that formal financing coupled with strong enforcement of regulations in the sector can lead to higher profits and increased margins in the industry. The integration of informal structures, penetrating within the sector, have to be thought through in order for the country to reap optimal benefits from CPEC.

Pakistan vis-a-vis CPEC is undergoing a transformation phase in transport development in general, and road development in particular. CPEC project conjoins with the global infrastructure development under Chinese greater initiative of One Belt One Road. Therefore, the conceptual understanding towards CPEC infrastructure should not be limited to the national scope. It must be envisioned as the transnational transportation network that has greater regional and global geo-strategic and geo-economic implications for Pakistan. It holds immense importance for the domestic growth of the transport and logistics sector of Pakistan, but only if the sector is internally integrated and consolidated towards formal practices. In line with the objective of formalizing the sector and bridging the gap between the available PSDP and the investment potential of the sector, with a focus to direct growth capital investments in micro, small and mid-size enterprises (MSMEs), is also leveraging investment in fleet financing, amid the potential of the road transport as a result of CPEC in Pakistan.

[1] http://www.aei.org/china-global-investment-tracker/

[2] Pakistan Economic Survey, Government of Pakistan, Pakistan Bureau of Statistics

[3] 2016, The Nation News, CPEC is an emblem of Pak-China friendship and the bedrock for future regional development

[4] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

[5] Impact of China Pakistan Economic Corridor, Muhammad Aqeel, 2016

[6] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

[7] http://pc.gov.pk/uploads/cpec/LTP-Web-Document26-12-2017-final.pdf

[8] Gravel roads

[9] Paved roads

[10] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

[11] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

[12] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

[13] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

[14] Pakistan Logistics Industry-Outlook and Growth Opportunities, 2016

[15] Pakistan Logistics Industry-Outlook and Growth Opportunities, 2016

[16] Pakistan Logistics Industry-Outlook and Growth Opportunities, 2016

[17] Pakistan Logistics Industry-Outlook and Growth Opportunities, 2016

[18] http://pc.gov.pk/uploads//plans//Ch27-Transport-logistics2.pdf

#阿法克·艾哈迈德·汗

V good sir

ReplyDeleteAfaq bhai your blog is outstanding.But thedream of CPEC as we all are expecting will not be fulfil until Gawadar port will not be fully operational and big shipping gaints will come and take some interest and start feeder services from Gawadar.Govt should be take some huge initiative to give some tax free or low charges port services to shipping companies. Presently in my knowledge there is no any Big shipping company start any service from Gawadar.C.O.S.C.O the biggest Chinese state run shipping company ships are not arrive regularly in Gawadar port so how we will be able to charm other companies in gawadar.

ReplyDeleteI agree with you Brother,

ReplyDeleteI hope that soon Pakistan will overcome all the obstacles that are obstructing the CPEC, and the days are near when Pakistan's economy will become stronger and stronger and its positive effects will reach the common man. InshAllah.

Have a Great Job Sir

ReplyDelete